Parents

Warren Buffett, a future billionaire and one of the richest people on the planet, was born in the largest city in Nebraska, Omaho.

His parents are typical representatives of the American family model. His father is a stock trader (later a congressman), his mother is a housewife with a modeling background. Robert is the youngest child in the family; he has two sisters - Doris and Roberta. Like most successful and wealthy people, Warren grew up looking up to his father, who was a pretty good entrepreneur. This had a huge impact on the formation of Warren's interests and his personality in general. The Buffett family lived in abundance, but Warren always knew he wanted more. Before his eyes, his father, who planned to become a journalist, decided at the right time to get comfortable on the stock exchange - the sale of securities was in demand more than ever. Buffett Jr., born during the Great Depression, always learned the lesson of this difficult time - you should always strive to become very rich.

These 4 Tips from Warren Buffett Will Help You Raise Financially Successful Children

Photo: Bloomberg

One of the richest businessmen on the planet, Warren Buffett, told what the main mistake is made by parents who want to instill in their children the basics of financial literacy, writes CNBC. He also gave some tips on how to teach your child how to handle money.

“Sometimes parents wait until their children are teenagers before they start talking to them about how to manage money properly. But it’s better to start this process in preschool age,” says the billionaire.

Buffett, citing a number of scientific articles, notes that certain patterns of behavior in a child’s brain are formed in the preschool period. For example, one study from the University of Cambridge showed that children are able to master basic concepts about money as early as 3-4 years of age.

Read also

11 habits of future millionaires. How to raise children to make them financially successful?

In this regard, the billionaire gave parents 4 pieces of advice on how to properly raise a financially literate child. Buffett instilled these rules in his own children.

1. Develop flexibility of thinking in children

If children face financial problems in the future, they will need the ability to think flexibly - thanks to this skill, they can get out of many difficult situations.

- Go to a museum with your children, discuss the paintings and invite them to draw their own. Let them use not only standard brushes and pencils, but also, for example, dish sponges, cotton swabs or their own fingers.

- At home, you can give new life to old things and garbage - for example, make a bookshelf from a box or checkers from bottle caps. This will help children learn to save money and take care of the environment.

2. Be frugal

As Ben Franklin once said, “A penny saved is a penny earned.” To help your children learn to manage their money, it is important for them to understand the difference between wants and needs.

- Give your child two jars of money: one for saving and one for spending. Any time he receives cash (for example, as a gift), talk to him about how he wants to divide the money between savings and expenses.

- Have your kids make a list or photo collage of several things they would like to buy. Then look at it together and decide which of the list is a need and which is a want.

3. Teach your child the difference between price and value.

We have all at least once overpaid for branded clothing or gadgets when we could have bought goods of the same quality, but at a lower price. Parents should explain to their children how advertising works and where they can find alternatives to expensive things.

- Make a list of products that you and your children are going to buy at the supermarket. But before going to the store, go to retailers’ websites and look at catalogs. Choose the option with the best prices.

- Watch advertisements and videos with your children. Ask them what catches their attention, and then discuss whether the items in the ad are actually worth buying.

Read also

Irony and memes. How to reach a young audience

4. Help children make good decisions

The key to making important decisions is to look for multiple options and then analyze them, says Buffett.

- Children need to be taught how to set priorities correctly. For example, simulate a situation - you want to buy a new TV, but the air conditioner in your house is broken. Therefore, you need to save money on its repair, because summer is coming. After you fix the air conditioner, you can think about the TV.

- When children want to buy something, ask if they really need it. If your child cannot give a reasoned answer, help him - think about the value of the goods together.

Several years ago, Warren Buffett became one of the heroes of the 12-episode cartoon “Secret Millionaires Club.” It tells how four teenagers learn financial literacy through the example of their business. Warren Buffett's character, in turn, acted as their mentor.

Subscribe to our channel on Telegram: @incnews

early years

The boy decided to “invest” for the first time at the age of 6, and his idea was crowned with success. Six-year-old Warren "invested" in buying a couple of cans of Coca-Cola, and later sold them at a premium. The fact that with any money you can make even more money stuck in the head of the young financial genius for a long time. Watching his father's success, eleven-year-old Warren decides to play on the stock exchange himself. So, after persuading his sister to share her savings, the kid buys three shares of Cities Service Preferred. Having paid 38 dollars for each of them, he sells them when the price of the securities increases to 40 conventional units - his earnings are approximately five dollars. Needless to say, the boy was upset when he learned that literally a week later their price soared to $200. Buffett remembered this lesson for the rest of his life, and it was this that formed the basis of the principle of long-term investing, which the entrepreneur has not changed to this day.

In 1942, the guy had to leave his beloved school in Omaha - his father won elections to the US Congress and the whole family moved to Washington. Here he graduated from Alice Deal Junior High School and Woodrow Wilson High School. At the same time, the young man does not forget for a second about his goal, which he set for himself at the age of 12 - to become a billionaire.

Who became Buffett's mentor?

Warren quickly realized that knowledge would help make him a “superman,” so he changed his attitude towards his studies and now sought to continue it. He once said that “investing in yourself is the most profitable investment that can exist.” Therefore, in 1950, Buffett tried to enter Harvard, but since he was only 20 years old at the time, he was immediately rejected. Even my father's political past did not help. The young guy was upset, because Harvard is one of the most prestigious educational institutions in the world. Its graduates have enormous career opportunities. Warren accepted defeat and entered the Columbia University School of Finance in Washington.

As it turned out later, this turn of fate served the young student well. Because one of his teachers was Professor Benjamin Graham, already a recognized expert in the field of the stock exchange at that time. This meeting was fateful for Warren. Graham's work “The Intelligent Investor” has become a reference book for the future rich man. Eyewitnesses recalled that during lectures Professor Graham often addressed the student, they discussed and shared opinions. The teacher perceived him as an equal. Warren himself called Graham the most influential person for himself after his father. The billionaire adopted a successful approach to financial policy from his teacher. Graham didn't consider investing to be a game of roulette, as it was at the time. He taught students to choose companies not by the price of shares on the stock exchange, but by their real value, that is, by the state of affairs in the company.

To this day, the billionaire's team deeply investigates the state of affairs in companies selling their shares. If the price is low, but there is potential, buy it! Buffett is not looking to make quick profits from stocks. Warren is a long-term play—on average, he holds a stock for about 10 years. Patience and endurance are at the top of the list of investment rules from the legendary businessman.

First steps

Moving to Washington became quite difficult for Warren, however, in the new place the enterprising boy found something he liked, which brightened up his melancholy a little. The occupation was, of course, making money. By delivering newspapers every morning before school (500 copies on five different routes), he was able to accumulate his first “serious” capital. Buffett's salary, $175 per month, was equivalent to the earnings of an adult. By the age of 14, the young man had $1,200 in assets, which he invested in the purchase of land in his native Nebraska. For what? To earn even more by renting it out.

Warren has already attracted outsiders to his next business project. During his senior year of high school, Warren and a friend decided to start buying decommissioned slot machines, the price of which ranged from $25 to $75. Buffett invested the funds, and his friend, who is interested in mechanics, brought them into working order. Next, the devices were installed in hairdressing salons, where they were extremely popular. Everyone was in the black: people who whiled away the waiting time playing the game, the owners who received a good percentage of the young entrepreneurs’ earnings, and, of course, the friends themselves. Having earned money, Buffett sold his business after graduating from school for $1,200.

Warren Buffett's childhood and family

The future legendary investor was born on August 30, 1930 in Omaha, Nebraska, in the family of a stock trader, later a congressman, and a housewife, a former fashion model. The couple had two more daughters - the eldest Doris and Roberta, the youngest child in the family.

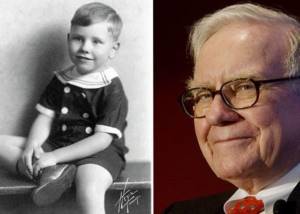

Warren Buffett as a child

His father’s profession influenced his son’s passion for finance. Already at the age of 6, he surprised his parents with his intelligence - he bought several cans of Coca-Cola and sold them to his family for twice the price. At the age of 11, pooling his savings with his sister, he purchased 3 shares of the Cities Service company, which supplied gas to city houses, on the stock exchange. Their price initially dropped, causing him to worry, and then rose from $38 to $40. At this point, Warren rushed to sell the shares and made a small profit, but soon regretted it bitterly, since later the value of the securities increased 5 times. This experience forced him subsequently to be more balanced, take his time and always give preference to long-term investments.

Warren Buffett in his youth

When his father entered Congress in 1942, the Buffetts moved to the US capital. In Washington, Warren continued his studies at school. He did not abandon business experiments either. At first, the boy became a Washington Post delivery boy and saved $1.2 thousand in a year. He used it to buy a plot of land of 40 acres (about 16 hectares), which he began renting out to farmers. Warren Buffett's success story At age 15, the young entrepreneur and a friend invested $75 in buying three used pinball machines and installing them in hair salons. Soon after this, the teenager announced to his family his intention to become a millionaire by the age of 30. Looking ahead, we note that his prediction was fulfilled almost on time - at the age of 31 he became the owner of a million-dollar fortune.

Education of Warren Buffett

Having said goodbye to slot machines, Buffett goes to the financial school of the University of Pennsylvania. 17-year-old Warren, who has read a lot of books about business and has his own entrepreneurial experience, is slightly disappointed with the level of teaching.

But the training did not last long - the guy was destined to return to Nebraska. After his father's resignation from Congress in 1948, Buffett transferred to the University of Nebraska-Lincoln. After graduating in 1949, Warren received a bachelor's degree in business administration. Next was Harvard, where studies did not work out, and later Columbia Business School, where Warren was greatly impressed by teacher Benjamin Graham, a professional investor and economist. According to Buffett himself, Graham had the greatest influence on his life after his father. After reading the economist’s book “The Intelligent Investor,” which urged not to follow Wall Street trends, Buffett was so inspired that he even took it as a basis for building his future business. In addition, after graduating from university, Buffett even managed to work under the leadership of Graham, which became an excellent school for him in both business and life.

Training and business development

When it was time to get a higher education, Buffett, at the insistence of his parents, went to the University of Pennsylvania. However, he quickly became bored with his studies: the enterprising young man knew much more about business than the theoretic professors. A year later, he left his studies and returned to Nebraska, where he again went into the newspaper business, only now with the rank of head of the delivery department, and then co-owner of the office.

Business was going well, and gradually the young entrepreneur's eyes turned again to the stock market. In addition to the fact that Buffett had his own savings, by that time he had already received his father’s money at his disposal and immediately began to increase the family capital. At the same time, he graduated from the University of Nebraska.

In 1952, at the age of 22, W. Buffett married Suzanne Thomson.

In 1954, Benjamin Graham finally offered Buffett a position as an analyst at his company, where Warren worked for two years. During this period, he became proficient in stock exchange operations and felt ready to start a big business. So, in 1956, Buffett returned from Washington to Omaha and founded Buffett Associates (“Buffett Partnershop Ltd”). Seven members of his family and friends contributed their shares to the capital, which amounted to $105 thousand. Interestingly, Buffett himself invested only $100 in the new project, although, as already mentioned, the size of his personal fortune at that time was already about $140 thousand. However, he calculated it is necessary not to touch your capital in case of an unsuccessful investment of other people’s money.

That's why Buffett's personal contribution was only $100. In 1958, the volume of partnership funds under Buffett's management doubled compared to 1956. The history of Buffett's investment decisions since then can be continued indefinitely, or rather, until the present time. And in the overwhelming majority of cases, these decisions turned out to be correct and brought profit to Buffett himself and the shareholders of his company. Buffett's salary as director of the fund was not guaranteed. At the end of the year, profits were distributed among shareholders at the rate of 4% per annum. If there was more profit, then the increase was divided between the partners and Buffett in a ratio of 3: 1. If the profit was less or there was none at all, then Buffett was left without a salary.

Of course, Buffett hedged his bets: in 1962, he found a textile company that was making losses. With a net asset value of $19 per share, no one wants to pay more than $8 per share. Nobody but Buffett. He started buying up the company. By 1965, 49% of the company belonged to Buffett Partnershop Ltd and Buffett was elected director. To the surprise of other shareholders, the new director did not develop textile production, and began to direct all the company’s income to the purchase of securities.

You may be interested in: Michael Dell: successful leadership styles top company manager

Buffett's next major purchase was the insurance business. In 1967, Buffett acquired National Indemnity Co., then GIECO, investing $8.6 million and $17 million, respectively, for the acquisition. Now the insurance sector in The Berkshire Hathaway empire is valued at more than $7.5 billion. Then, in 1967, The Berkshire Hathaway paid dividends for the first and last time. Since then, all profits have been reinvested, which has become another of the secrets of Buffett's success.

Buffett Partnershop Ltd was wound up in 1970. All shareholders were offered to receive either shares of The Berkshire Hathaway or cash. Buffett, naturally, chose the former. Thus, he became the owner of 29% of the shares of The Berkshire Hathaway. For 30 years, he has not sold a single share, but he also bought one. He now owns 42.7% of the shares of this company.

Buffett made his most successful purchases during or immediately after major stock market crises, when most investors avoided the market. Thus, during the crisis of 1973, Buffett bought a large stake in the Washington Post newspaper for $11 million (now this stake is worth $1.1 billion). In 1988, shortly after Black Thursday 1987, The Berkshire Hathaway spent $1.3 billion to buy shares of Coca-Cola. In addition, The Berkshire Hathaway's portfolio includes large stakes in Gillette, McDonald's, Walt Disney, Wells Fargo Bank, General Rea and others. The price of shares of The Berkshire Hathaway itself has grown over 35 years from $8 to $43,500.

Professional activity

In 1957, Buffett decided to start an independent business for the first time - returning to his native Omaha, he created an investment organization. With persistence and perseverance, he convinces a number of entrepreneurs to entrust him with amounts equal to 25 thousand dollars. And it works! His program was minimal - 10% per year (just to beat the growth of the Dow Jones). Just two years later, when the organization was dissolved, his investments grew by 29.5%, while the Dow Jones grew by only 7.4%.

The next project was an almost bankrupt textile factory, which was in a deplorable state, like the entire textile industry in the United States. By actively buying shares, and subsequently heading production (49% of the shares are at his disposal), Warren becomes the owner of the financial market leader, whose fortune is estimated at $360 billion - the owner of the Berkshire Hafrtway factory.

Then there were many projects and not so large investments, but another wave of success overtook Buffett in the 70s. The social assistance law adopted in the United States in 1967 pushed the businessman to acquire five insurance companies at once, which subsequently increased his fortune to $28 billion.

Billionaire Lifestyle

The billionaire is distinguished by his exceptional modesty. He still lives in the old house in Omaha that he bought back in 1958. He loves fast food and drinks five cans of Coca Cola every day: three regular flavored ones during the day at work and two cherry ones at night at home. He drives a used Honda and, it seems, has no intention of changing it. He dresses in clothes bought at a sale. The billionaire is deeply convinced that things should happen to a person, and not vice versa. The only passion for luxury can be attributed to the purchase of a private jet. Although he sees it more as a fast means of transportation.

His wife and children fully share their father's views. In general, Warren and his first wife managed to perfectly accurately divide the huge inheritance between their three children. At one time, they created three charitable companies with equal capital of $10 million each and passed them on to their children. For some time he annually replenished their funds. But one day all his children received letters in which their father informed them that he would no longer help them. That is, the funds are everything they inherit from their billionaire father. He made this decision on his own, without collecting or asking the opinions of the heirs themselves. The most interesting thing is that they completely shared their father’s opinion. This became the main activity of the children: they all became philanthropists. In addition, Peter Buffett is now a famous musician, composer and writer. And Howard is a farmer and photographer.

Warren Buffett in the new millennium

Despite the fact that Buffett's business development took place in the second half of the twentieth century, he continues to be active in the new millennium. So, in 2009, the businessman’s already quite large assets were replenished with the transcontinental railway BNSF Railway, and in 2015 with the island of St. Thomas in the Aegean Sea (together with Alessandro Proto). In addition, Buffett tirelessly monitors market trends - he even changed the type of investments he makes. If earlier the investor preferred to invest in production, transport and insurance businesses, then in 2021 he purchased Apple shares with a total value of $1 billion, slightly later increasing the amount to 1.6 billion. Previously, the businessman had not been seen to invest in enterprises developing advanced technologies.

Charity

Warren Buffett, a member of the Bill and Melinda Gates Foundation and also one of the board members, annually donates funds to charity. Thus, having promised to transfer most of his fortune to charitable organizations, the billionaire deducts funds from his personal assets every July 1st. One of these donations is shares of the Berkshire Hathaway investment fund (about $1.9 billion). Buffett also holds the title of "most generous philanthropist" - in 2010, he announced the transfer of $37 billion (50% of his wealth) to five different foundations.

Personal life.

Despite huge bills and the opportunity to buy an entire island, Buffett's personal life can hardly be called cloudless. His first wife, Susan Buffett, with whom he lived until 1977, died in 2004. Warren married for the second time on his 76th birthday - the financier's chosen one was an immigrant from Latvia, Astrid Menks. Buffett's relationship with his children is quite complex - the billionaire, who tried to raise them without frills, often went too far. So, one day Warren’s daughter, Susie, having asked him for 20 dollars to park a car, was obliged to write a receipt for the funds taken, and son Howard, who asked his father for help in buying a farm, received it, but in a very unexpected form - Buffett bought the farm and rented it out for rent for my son. So understand these billionaires.

Warren's wife and children

It's time to talk about the personal life of the legendary investor. At the age of 22, he married Susan Thompson, a girl from his native Omaha. She bore him three children: Susie, Howard and Peter and lived with him for 25 years. But Warren was always absorbed in his business, not paying enough attention to his wife and children. Of course, he loved them very much; warm family relationships were instilled in him by his parents. But his main passion always remained work.

Susan was sociable, loved parties, and sang in cabaret. That is why she left him for an idle life in San Francisco. But they did not divorce and even appeared in public together from time to time. So, they lived in different cities until Susan died of cancer in 2004. In honor of the memory of his first wife, Buffett founded the Susan Thompson Buffett Foundation and still makes periodic contributions to it. 2 years after the death of his wife, he remarried his longtime girlfriend Astrid Menks, 16 years his junior. It is curious that they were introduced by his first wife.

The Buffetts raised their children to be self-sufficient, simple people. They studied at a city school, communicated with peers from their street. The businessman didn’t even have an office for a long time. To understand how much the Buffett family was and remains an ordinary ordinary family, it is worth knowing about an interesting fact: the offspring learned that their father was a billionaire only when he was included in the Forbes list. They and those around them were surprised, to put it mildly. And this did not change them at all, nor their behavior or lifestyle.

Interesting Facts

- Buffett's favorite cartoon is DuckTales. It is interesting that after studying the biography of the billionaire, one can draw many analogies with the main character of the film.

- The media calls Buffett the "Oracle of Omaha"

- After 50, life is just beginning - Buffett earned 99% of his wealth in his sixties

- Buffett knows the value of everything, especially his time - in 2014, a businessman from Singapore paid $2.2 million for lunch with Buffett.

- Outperforming the market is Buffett's strong point. In this matter, his track record is the greatest among all world investors.